- 💤 Over 2 million federal workers risk going unpaid during a shutdown.

- ⚠️ A one-week shutdown can reduce U.S. GDP by 0.2 percentage points.

- 🧠 Consumer confidence falls during government shutdowns, slowing big purchases like homes.

- 🏠 FHA and VA loan processing delays disrupt real estate markets in cities like Las Vegas.

- 🎓 Student loan services and FAFSA processing are delayed, impacting borrowers and schools.

The Financial Domino Effect of a Government Shutdown

A government shutdown may seem to affect only politicians and federal offices in Washington, D.C. But it also affects homes, businesses, and entire economies. For example, homebuyers, students, investors, and especially federal workers can see missed paychecks, stalled real estate deals, delayed loans, and less consumer confidence. This article explains how a federal shutdown affects everyday economic functions. It focuses on how places like Las Vegas feel the most impact.

What Is a Government Shutdown?

A government shutdown happens when Congress does not approve a federal budget. Or, it happens when Congress does not pass a short-term funding bill for government departments. This usually happens because political parties disagree. They cannot agree on how much money the federal government should spend, or what to spend it on. When funding runs out, nonessential government work stops. This means affected agencies must stop working until a budget deal is made.

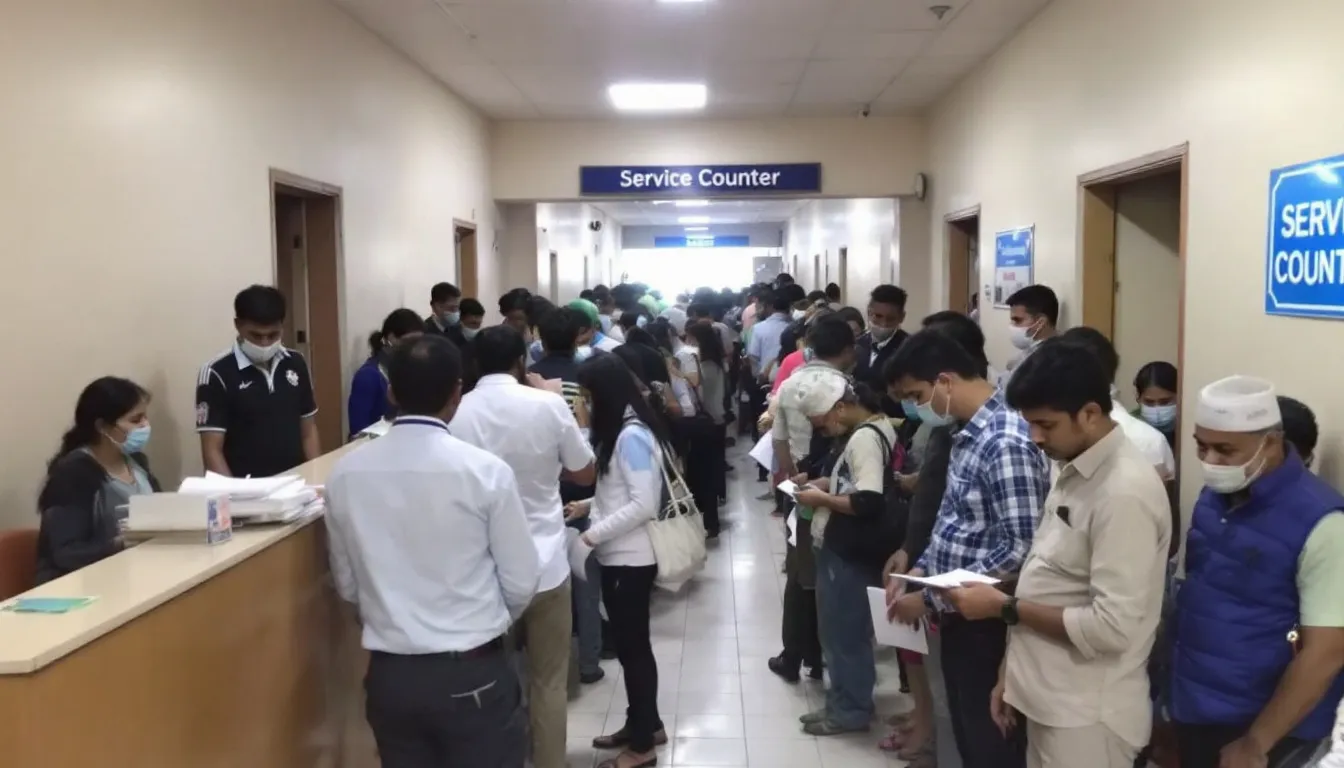

During a government shutdown, federal agencies have rules for what services are “essential” and “nonessential.” Essential services, like national defense, law enforcement, air traffic control, and Medicare payments, keep going. But all other work slows down or stops completely. Departments such as Housing and Urban Development (HUD), Internal Revenue Service (IRS), and the Small Business Administration (SBA) either greatly reduce staff or close. This reduction in work affects many parts of daily economic activity.

Why Do Shutdowns Happen?

Government shutdowns often result from political maneuvering. Republicans and Democrats in Congress disagree on spending bills. This often happens because of big issues like defense spending, healthcare policy, or immigration. When they disagree, the government may not have an approved budget on time.

Here are some important government shutdowns from recent history:

- 1995–1996 (21 days): This shutdown happened because President Bill Clinton and House Speaker Newt Gingrich disagreed on funding for Medicare and public health.

- 2013 (16 days): This one started because of disagreements over the Affordable Care Act (Obamacare). Some lawmakers tried to stop the law from being put in place.

- 2018–2019 (35 days): This was the longest U.S. government shutdown. It was because President Donald Trump and Congress disagreed over money for a border wall.

Each of these shutdowns caused economic problems. These problems affected more than just government offices. They led to slower services, delayed paychecks, and less public trust in government.

Federal Workers and Missed Paychecks

America's roughly 2.1 million federal civilian workers feel the most direct effect of a government shutdown. CNN reports that about 800,000 of these employees must work without pay during a shutdown, or are sent home without pay.

Essential personnel must keep working. This includes TSA agents, Federal Aviation Administration (FAA) controllers, and law enforcement officers. But they do not get paid until a budget is restored. For people who live paycheck to paycheck, this quickly becomes a serious money problem.

In Las Vegas, federal jobs include airport security, postal workers, Veterans Affairs staff, and Homeland Security agents. Even a short gap in pay can upset household budgets there. Many of these workers have monthly bills, like rent, car payments, and child care. They cannot afford to miss income.

Congress has usually approved back pay after past shutdowns. But there is no law that guarantees it. Workers often feel unsure about their money. They depend on savings, credit, or emergency services. And when shutdowns happen again, psychologists and financial experts warn about the mental strain and stress from not knowing when paychecks will come.

To lessen this problem, financial planners suggest federal employees save enough money for 1 to 2 months of expenses. But this is hard to do for many middle-income households.

How a Shutdown Impacts Consumers

Federal employees likely feel the worst effects. But the average American consumer is not safe from the side effects. Here is how shutdowns can affect the everyday economy:

- Slower Service Delivery: Passport applications and renewals stop. Veterans and seniors may have delays with benefits. FEMA help can be delayed in areas hit by natural disasters.

- Disrupted IRS Services: The IRS reduces its work. This means long waits for help and delays in sending tax documents and refund payments.

- Interrupted Small Business Loans: The Small Business Administration (SBA) usually stops approving most loans. Business owners who need money to start or for equipment may face delays. This can delay business start dates or growth.

- Consumer Confidence Drop: Consumer confidence drops a lot during past shutdowns, say surveys from the Conference Board and University of Michigan. People fear missed paychecks, service delays, and overall instability. This makes households less willing to spend.

In cities like Las Vegas, these changes can slow down the local economy. Many people there work in hospitality or gig jobs. These industries are easily affected by changes in travel and consumer spending. So, a lack of federal support or income from services like SNAP can cause quick problems.

Student Loans and Financial Aid Disruption

The timing of a government shutdown can cause big problems for college students and their families. This is especially true if it happens around fall semester aid payments or FAFSA deadlines.

Student loan providers are affected through the Department of Education. CNBC reports that the Department may keep handling loan work. But outside companies that manage loan servicing, billing, and customer support for borrowers may slow down or even close for a time.

Problems include:

- Delayed FAFSA Processing: Federal student aid applications may pile up. This delays grant and loan offers for future semesters.

- Limited Customer Service: Borrowers paying back loans may have trouble reaching loan companies. They might not be able to adjust income-based repayment or ask about forgiveness programs.

- Delays in New Loans or Payments: Schools could be unsure about giving out incoming loan money. This affects tuition billing, on-campus housing, and meal plans.

Lower-income college students depend on Pell Grants or federal loans. They are most at risk. Even small delays can stop access to school resources. Or, these delays can force students to take out loans from private lenders with worse conditions.

Real Estate Impacts: FHA/VA Loan Delays

Shutdowns do not stop people from buying or selling homes. But they can greatly slow down the mortgage process. This effect is especially strong in markets like Las Vegas. FHA and VA loan products are used a lot by first-time homebuyers and veterans there.

Important delays during a shutdown include:

- FHA Loan Processing: The Federal Housing Administration says it keeps basic work going during short shutdowns. But in reality, many lenders slow down or stop processing. This is because they have no help for checking details.

- VA Loan Appraisals and Underwriting: VA loans cannot move forward without staff to review or approve applications. This delays closings.

- IRS Tax Documents: These are often needed to check income. But they become impossible to get during a shutdown, making loan approvals harder.

- USDA Loans: These loans are usually stopped completely during a shutdown. This can stop rural housing deals.

These problems make buyers more worried. And they make closing times longer. This can slow down real estate deals. Sellers might choose not to work with government-backed buyers. Instead, they might choose conventional or cash offers. Real estate professionals should talk early with clients and loan partners. They should also look at other loan options to avoid problems.

Investor and Market Reactions

Wall Street does not like uncertainty. And few events make investors more worried than the chance of political problems. Historically, stock markets have seen short-term drops at the start of shutdowns. This is especially true if investors see no clear date for ending the shutdown.

A Reuters report says the S&P 500 index often drops for a short time during shutdowns. This is mainly because of worries about lost government spending, low consumer confidence, and lower expected company profits.

But market losses are rarely very bad. This is unless the shutdown causes bigger risks to the whole system. Defensive sectors, like consumer staples or utilities, often do better. Real estate investments also tend to keep their value during short shutdowns. This makes real estate a potentially safer long-term choice for investors dealing with problems.

Good strategies for investors include:

- Adjusting investments to include more safer options.

- Having cash ready for possible price drops or chances to buy.

- Not selling in a panic, especially if shutdowns are expected to be short.

Shutdowns can be annoying. But most do not stop long-term investment growth. They often offer cheaper ways to buy into parts of the market that are not doing well.

Economic Impact on GDP and Confidence

Even short government shutdowns slow down the economy. Economic analysts at Goldman Sachs say a single week without federal work can reduce U.S. Gross Domestic Product (GDP) by about 0.2 percentage points for the quarter.

This happens for several reasons:

- Employees sent home without pay lose wages.

- Government contracts stop, or buying is delayed.

- Less consumer spending because benefits are delayed.

- Less work from small businesses when federal loans or permits are frozen.

Las Vegas's economy depends a lot on federal contract workers. It also depends on tourism events that get federal funding. So, it could see increasing slowdowns in visitor spending, hospitality jobs, and construction work.

And the drop in consumer confidence that comes with these shutdowns shows up as fewer home purchases, slower car sales, and fewer major purchases overall. This also slows down GDP growth from consumers.

What’s at Stake if the Shutdown Drags On?

Short shutdowns are annoying for the economy. But long ones become big problems. After three or four weeks:

- SNAP (food stamps) money begins to run out.

- WIC programs for women, infants, and children may stop payments.

- Federal contractors, often in transportation, maintenance, and tech, face work stoppages.

- Tourism suffers. This is because event venues that need federal partners or permits must cancel plans.

In Las Vegas, these problems hit hard. Not only the real estate market, but also construction crews building infrastructure with federal support. And event promoters depend on tourism working well. Also, hospitality workers depend on steady crowds.

Projecting Shutdown Length: What Are the Odds?

The average U.S. government shutdown has lasted eight days. But history also shows that political disagreements can get worse fast. The 35-day shutdown in 2018–2019 shows that if negotiators are not ready to compromise quickly, the problems can last much longer than a week.

Factors that predict how long a shutdown lasts:

- Strong disagreements in Congress.

- Upcoming elections or goals for political power.

- Media coverage and public pressure.

Despite all the political show-offs, the more economic damage the shutdown causes, the more pressure there is to end it.

Advice for Las Vegas Homebuyers, Sellers, and Agents

If you are involved in real estate in Las Vegas, as a buyer, seller, or agent, here are some steps to take ahead of time to reduce problems:

- Plan for delays if using government-backed loans: Work with lenders who have plans for shutdown problems.

- Look at other ways to get money: Consider conventional or portfolio loan products.

- Check buyers more closely: Sellers might favor offers that do not depend on delayed federal checks.

- Be flexible on closing dates: Buyers and sellers should add extra time to their contracts. This helps avoid cancellations caused by government delays.

Smart Investment Moves During a Shutdown

For investors, federal shutdowns test two things: strategy and patience.

Good actions include:

- Adjusting investments to hold assets that do not change much in value.

- Buying more in essential sectors like utilities, food, and healthcare.

- Having cash for chances to buy stocks or properties that are worth more than their price.

- Not making emotional decisions based on short-term political power plays.

Shutdowns can be annoying. But most do not stop long-term investment growth. They often offer cheaper ways to buy into parts of the market that are not doing well.

Navigating Uncertainty with Preparedness

Government shutdowns start in Washington. But their effects are felt by everyday people. Federal employees miss pay, students wait for help, and Las Vegas homebuyers get stuck with loan problems. These events cause problems. But the key is preparation: saving money, having different kinds of investments, and getting good local advice from professionals who have dealt with problems before.

If you are a buyer, seller, or investor, you do not have to stop your plans during political disagreements. Be informed, stay flexible, and talk with local advisors like Steve Hawks. They understand the market details that come with uncertainty from shutdowns.

References

- Wang, M. (2023, September 28). Government shutdown: Federal employees would work without pay as Congress fails to reach a deal. CNN.

- Luscombe, B. (2023, September 28). Shutdown worries hit Wall Street as budget deadline looms. Reuters.

- Mutikani, L. (2023, September 27). U.S. government shutdown could cost economy billions. Reuters.