- 🏠 43% of home sellers cut their asking prices in late 2024 and early 2025. This shows sellers were unsure about their prices.

- 📉 The Fed’s 0.25% rate cut in September 2024 didn't change mortgage rates much. Mortgage rates are linked to Treasury yields.

- 🏡 Only 28% of homes sold above their asking prices in June 2025, down from 32% the previous year.

- ⌛ Homes are now spending an average of 58 days on the market—up from 51—showing buyers take more time to decide.

- 📊 Low housing inventory still gives sellers an advantage, mostly for homes priced in the lower and middle ranges.

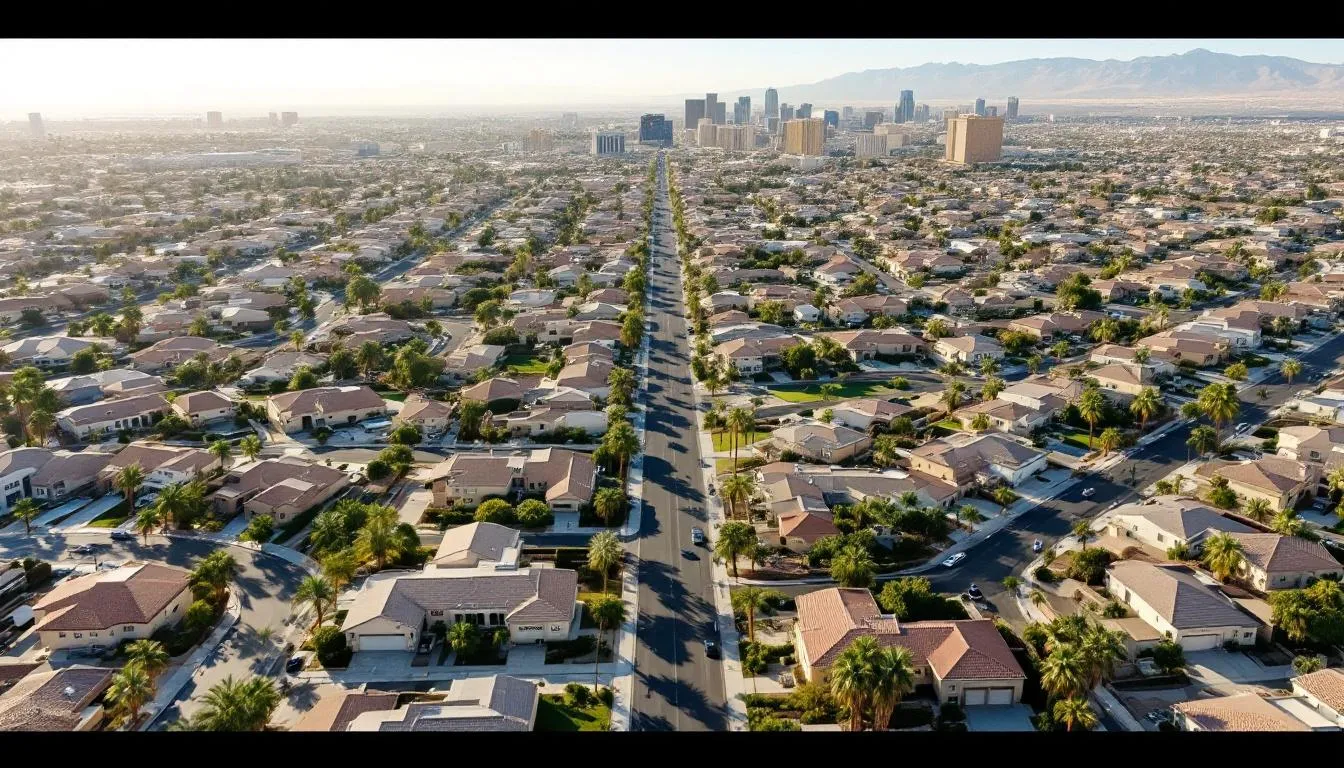

On September 17, 2024, the Federal Reserve cut interest rates by 0.25%. This change affected the housing market. But unlike before, this didn't cause a lot of homes to go up for sale. Sellers still don't want to list, especially in busy areas like Las Vegas. So, homeowners and real estate pros need to deal with interest rates, how much homes have gained in value, what buyers are doing, and how people feel about the market. This guide explains why rate cuts alone aren't making more homes available. And it offers 12 housing market tips on how to work with sellers who are being careful.

Why Sellers Aren’t Listing (Yet) After Fed Rate Cuts

Homeowners across the nation, especially those who bought or refinanced between 2020 and 2022, are keeping deals that seem too good to give up. Many have mortgage rates as low as 2.65%, Freddie Mac data shows. The idea of giving that up for a mortgage closer to 6%, even after slight Fed rate cuts, feels like a bad financial step.

These low rates are doing more than stopping homes from being listed. They are freezing the market. Homeowners don't want to sell. This is because of higher loan rates on their next home. It's also due to higher property taxes, insurance, moving costs. And they are unsure what they will find when they try to buy a new home.

All this hesitation also comes with fear. A recent report from Clever Offers says 43% of sellers cut their asking prices during late 2024 and early 2025. Many sellers worry they will lose on their next mortgage rate. Also, they worry they will not get the most money for their current home. This is clearest in Las Vegas. There, people bought homes very fast during the COVID-19 housing boom. This has made sellers in Las Vegas afraid to sell when the economy is uncertain. They have financial and mental reasons to hold back.

The Gap Between Fed Rate Cuts and Mortgage Rates

Many people mistakenly think that when the Federal Reserve cuts interest rates, mortgage rates drop right away. This is a common mistaken idea. Mortgage rates are more linked to what the 10-year U.S. Treasury yield does. Many things affect it. For example, how investors feel, what people expect for inflation, how much global risk people want to take, and even world events.

The problem is this: Even when the Fed cuts short-term rates, Treasury yields might go up if investors think inflation will continue or if world risks stay high. This would also make mortgages go up to cover that risk. Today's yields show the market is unsure. Inflation is still about 3%, which is more than the Fed's 2% goal. And fewer new jobs are being added. And the 2024 election results, along with current world fights over trade and energy, make things even harder to predict.

This means homeowners waiting for quick drops in mortgage rates might wait much longer than planned. And with few homes for sale, buyers sensitive to rates will keep feeling the pinch. This puts pressure on sellers to be flexible. Otherwise, they might have to wait even longer.

Inventory is Low—This Gives Sellers a Hidden Advantage

When there's less of something, people compete more. This is very true for housing. With fewer homes for sale, especially those under $500,000, sellers have more power than they realize.

According to Redfin, only 28% of homes sold above asking in June 2025. This compares to 32% during the same month in 2024. This shows the market is slowing down some. But good listings can still do well. Homes that are clean, updated, staged well, and priced right still get many offers in areas with few homes for sale.

In markets like Las Vegas—especially in Summerlin, Henderson, and Spring Valley—many buyers want homes. These buyers include pros moving to the area and investors from other states. Homes with new features, ways to make money (like ADUs or basements you can rent out), or lot sizes that fit zoning rules often sell quickly.

Even if rates stay a bit high, few homes for sale means listing now could offer sellers a good chance for motivated buyers to see their home. This would be before more rate cuts bring many other homes onto the market.

12 Housing Market Tips to Motivate Today’s Sellers

For agents, brokers, and homeowners who know a lot, success in this market depends on knowing how sellers think and giving them useful ideas. Here are 12 housing market tips to help sellers decide to list their homes:

1. Use Scarcity to Build Urgency

Make sure homeowners understand the special spot they are in. With not many other sellers, even a basic home can look good next to others that aren't well-prepared. Fear of missing out can get people moving. Show this with current sales prices and local market info.

2. Show Equity Gains

Sellers often don't realize how much money their home has gained. Use a Comparative Market Analysis (CMA) and public data to show how much the home's value has gone up since 2020. Show how this gained value can help with big life buys, like a retirement home or college tuition. This makes selling seem like a step toward their future plans.

3. Show How Many Cash Buyers There Are

Even in a time of high rates, cash still matters. Many investors from other states, flippers, and retirees still offer all cash. In Las Vegas, about 30% of deals in early 2025 were cash purchases. This is a strong point to make to sellers worried about loan delays or appraisal issues.

4. Explain Other Ways to Move

For many people thinking of selling, the time between selling and buying, which is unknown, makes them nervous. Offer solutions like "leaseback after sale," bridge loans, or short-term rental options as short-term choices. Also, suggest working with moving experts or services that make moving easier. This removes another reason not to list.

5. Link Listings to Life Events

A person sells often due to feelings and life changes. Ask homeowners to think about changes in work, school areas, family size, and even needs as they get older. When you link a home sale to being happy with their life later on, the talk becomes useful, not just about money.

6. Give New Buyer Demand Data

Up-to-date information builds trust. Share how many buyers are asking questions, how many people come to open houses, and how many times homes are viewed online from sites like Zillow and Realtor.com. Very local data, especially for neighborhoods like Aliante or Mountain’s Edge in Las Vegas, can help sellers who are unsure see the exact demand in their area.

7. Make Financial Ideas Easy to Understand

Explain big economic ideas in simple, personal terms. For example, instead of saying "the Fed is likely to start cutting rates more often," explain: "A lower federal funds rate might make borrowing a little cheaper for buyers. But you still have an advantage because there are not many homes for sale." Sellers often can't decide when they feel like too much is happening. Clear talks make it easier for them.

8. Work With Smart Lenders

Creative lending doesn’t just help buyers. It helps sellers too. Show when buyers offer assumable loans or buydowns paid by the seller. These tools can make a sale go more smoothly when times are tough. Work with lenders to teach sellers how loan perks can help them sell faster and for a price closer to what they want.

9. Offer the “Sell High, Rent Low” Idea

In markets like Las Vegas, new home loans might cost three times more each month than what current owners are paying. Show good rental choices for six to twelve months to counter this. This choice lets sellers keep their profits while rates become steady. Or they can look for their next ideal home.

10. Use Social Media Well

Do more than just announce listings. Post before-and-after stories, what clients say, and short videos that explain common worries. Show real market data in these videos. One good example: a video showing a viewer "5 things we learned from our Las Vegas home sale in 2025" can get people interested, reach more viewers, and build trust.

11. Set Real Timelines and What to Expect

Realtor.com says the average home spent 58 days on the market in early 2025. This is up from 51 days in 2024. Buyers are looking around more and offering less money. Tell sellers to expect a bit longer sale time. But remind them that serious buyers are still out there. And they know a lot about the market.

12. Become an Advisor Who Uses Facts, Not a Closer

Agents who gain trust by giving advice, not pushing them. Help clients make sell/buy choices openly and honestly. This includes telling them to wait if it is not the best time. This creates repeat clients and referrals, especially in markets that are hard to guess.

Spotlight: Steve Hawks' Las Vegas Perspective

Steve Hawks, who has long worked in real estate, says the Las Vegas market still has problems because of uncertainty. But small parts of the market have many chances to sell. Areas like Summerlin, Anthem Hills, Enterprise, and Silverado Ranch still get many offers for homes under $500,000 that are ready to sell.

Why? People moving in from California, Arizona, and Chicago keep buyers wanting homes. This is true especially for neighborhoods with things they can walk to. Also, homes that work for multiple generations, like those with two master suites or ADUs, are popular.

Smart sellers in Vegas are setting fair prices. They offer pre-appraisals right away. Or they fix small issues to make buyers less hesitant. Homes priced too high stay on the market. Homes listed with a plan sell.

You Can’t Time the Market, But You Can Be Smart About It

Waiting for the perfect mix of low mortgage rates and the highest prices ever will almost always lead to disappointment. Real estate markets go through cycles. They are affected by feelings. And they can be changed by things no homeowner can control.

Instead of aiming for "perfect timing," aim for a smart spot. Selling during a pretty good time, like now when rates have gone down a little and there are still few homes for sale, can give sellers more power. This is better than waiting for a time of low rates and many homes for sale, where competition lowers profits.

Why Home Sellers Who Act Fast Will Get the Most

Fed rate cuts can be confusing. For one, they show that the economy needs help. But also, they eventually make more people join the housing market. For sellers, more people mean more competition.

Listing when buyers are active, but other sellers are still hesitant to sell, can get better prices, have fewer conditions on the sale, and close faster.

If you are thinking of listing or just want to know where you stand, talk to pros. Figure out your home's value gain. And check how many buyers want homes in your area. Doing something based on real knowledge is better than waiting because of news headlines.

Cited Sources:

- Realtor.com. (2025).

- National Association of Realtors. (2015–2016). Historical days-on-market data.